Consumers in Belgium apparently feel least anxious about online security than people in any other European country.

Consumers in Belgium apparently feel least anxious about online security than people in any other European country.In an Index that tracks trends in consumer perception of security issues among approximately 8,500 people in nine countries, Unisys has reported that ID theft and fraud fears have surged in the last six months as recession bites.

“Reports that fraudsters are increasingly moving online, in addition to well publicized security breaches, may have also helped push up the Unisys Security Index for Internet security concerns from 105 a year ago to 121 in the UK,” the company said.

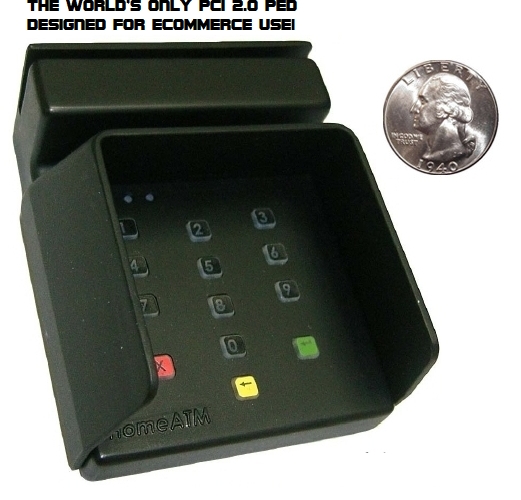

Editor's Note: See the device on the left? Fraudsters hate it because instead of "Typers" consumers become "Swipers." I love the irony... "Consumers "swipe their card information" vs. Fraudster's being the "Swiping Type"...

Virtually "every" security expert knows that entering a card number, expiration date and CVV with a keyboard is the exact "type" of transaction that allows fraudsters to "swipe" your financial details. On the flipside, when you "swipe" your own card details with our SafeTPIN terminal, and enter your PIN, it's done "outside" the browser space, is "instantaneously" 3DES encrypted "inside" the box" and the data is never transmitted in the clear.

In addition to 3DESD end-to-end encryption, HomeATM employs DUKPT key management AND also encrypts the Track 2 data.

These procedures helped the HomeATM "SafeTPIN" become the FIRST and ONLY payment terminal/PIN Entry Device IN THE WORLD, designed solely for e-commerce to be PCI 2.0 PED Certified.

Thus, HomeATM is also the "FIRST and ONLY" provider of "Tried and TRUE" PIN Debit for eCommerce." The card is present, the Track 2 data is captured (including the PIN Offset (PVKI) AND the PIN Verification Value (PVV) and the PIN provides 2FA (two factor authentication)

Again, on the flip side, with a software PIN Debit "application" (see graphic below/right) the card is NOT PRESENT, the Track 2 data is NOT captured, (nor is the PVKI/PVV), and the PIN does NOT provide 2FA, because the Primary Account Number (PAN) could have been purchased for a dime online. So, if your perception is that there's "TWO" Internet PIN Debit choices, hardware or software, it's time to re-evaluate...because the truth is:

There's only ONE TRUE PIN Debit "solution" for the web. HomeATM...period. Speaking of "conventional" you can visit us at Booth 347 at the ETA Convention. Oh...and did I mention that HomeATM is EMV/SmartCard/Chip and PIN ready? I think I just did...back to the article

According to the survey, 69% of UK consumers are now concerned about computer security and 65% are worried about their safety and security when shopping or banking online.

According to the survey, 69% of UK consumers are now concerned about computer security and 65% are worried about their safety and security when shopping or banking online.The study assessed attitudes towards national security and epidemics, financial services security, as well as sentiment towards spam, virus and online financial transactions, and physical risk and identity theft.

It used measures of consumer perceptions on a scale of zero to 300, with 300 representing the highest level of perceived anxiety. The relaxed Belgians scored a low 94 on a rating of internet security concerns.

Overall, the average score for citizens of the nine countries surveyed is 133, representing a moderate level of concern. Those surveyed are most concerned about financial security and least concerned about Internet security.

Unisys said its twice yearly survey presents an interesting social indicator regarding how safe consumers feel on key areas of security.

Some 72% of UK citizens believe they are at greater risk from identity theft and related crimes such as credit card fraud, as a result of the financial crisis

Four out of every five people in Germany are extremely or very concerned about identity theft, yet under half would accept biometric technology to verify their identities.

As many as 88% of consumers are concerned about other people obtaining and using their credit card, debit card or bank account details or are concerned about others gaining unauthorized access to or misusing their personal information.

“Fraud fears have deepened as a result of the financial crisis,” Neil Fisher, VP at Unisys said.

The company found that bankcard fraud is the greatest single area of concern across all markets, with concerns about misuse of credit or debit card details being the top concern among adults in five countries and the number two concern in four more countries.

Identity theft is seen as the second greatest area of concern, being the number one concern in three countries and the number two concern in four more.

Since the last survey six months ago, Unisys measured a jump of ten-points in its Internet Security Index and charted a significant six-point rise in its Financial Security Index. Its National Security Index continues its downward trend, while its Personal Security Index is essentially flat.

0 comments