Posted by

John B. Frank

Thursday, February 12, 2009

Yesterday I provided a list of (so far) the 157 banks and credit unions who have been affected by the Heartland Payment Systems breach. (along with the number of cards each bank was issuing as replacements.)

This morning Finextra did a story on a Independent Community Bankers Association (ICBA) "poll" the results of which, are suggesting that thousands of community banks are at risk from Heartland breach

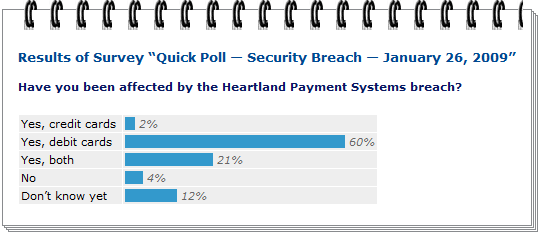

The ICBA conducted an informal poll asking community banks "Have you been affected by the Heartland Payments Systems Breach?"

Amazingly, only 4% responded "No."

Informal or not, with 82% answering in the affirmative (12%, don't know) these are alarming numbers for all concerned.

With nearly 5,000 members, representing more than 18,000 locations nationwide, the Independent Community Bankers of America, represents community banks of all sizes and charter types throughout the United States. The ICBA conducted the online poll in late January and here are the results:

Heartland hasn't really said much

1. They apologized for the inconvenience and said they're heartbroken. (Translation, HPY = bad ticker)

2. Said it wasn't their fault, they passed PCI and nobody shared with them information about past breaches, which could've maybe prevented it. (Translation: a standard deflection, we did what was asked, we did all we could do..)

3. They said the industry needs to incorporate end-to-end encryption (Translation: I guess we didn't do all we could do)

One thing we do know is that the ICBA poll certainly implies that thousands of banks have been affected. Sure it was an informal poll, but even though the numbers only add up to 99%, it's 100% more information than we've gotten out of the Heartland.

![Reblog this post [with Zemanta]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_sZ79zJHhAZZJhAsaeKtpM4jz0oc-xn1ULeQycQgM97kKqS_lwcrHksFjUXtwGJkoHAI40iRCZj0xaGWxIwux5qQVmV39cY-jcWTwmgxAyuf7Q4dxQMUPY2FSt4a1p01l6a5uWySIq5pYoqVRblH3A=s0-d)

0 comments